Colorado Voters Expected To Approve Taxes On Legal Marijuana

Whereas activists sold legalization to voters as a win-win for civil liberties and government coffers alike, a small opposition campaign is now pushing to tax marijuana at rates similar to taxes on beer, for which the state collects 8 cents per gallon. Some marijuana proponents in Colorado say they’re opposing Tuesday's referendum to allow two taxes on the drug, which was legalized for recreational purposes a year ago.

Voters will decide whether to approve a 15 percent excise tax on marijuana, to fund school construction, in addition to a 10 percent tax to pay for marijuana regulatory enforcement.

"Our alcohol system is regulated just fine with the taxes they have, so we don't see any need for this huge grab for cash from marijuana," Miguel Lopez, volunteer coordinator for the anti-tax group, told the Associated Press this week.

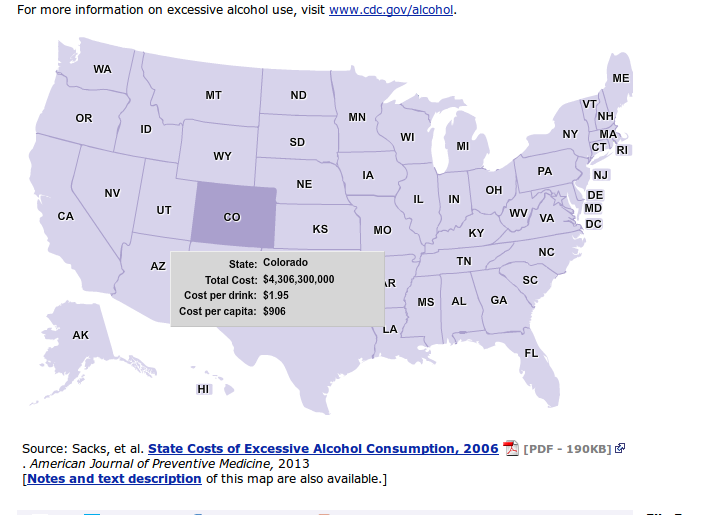

Apparently, Lopez’ idea of “just fine” doesn’t consider the failure of state and federal taxes to sufficiently cover the expense of alcohol to society, which cost the United States some $223 billion in 2006 alone, according to the U.S. Centers for Disease Control and Prevention. Excessive use of alcohol that year cost Colorado $4.3 billion when including costs from healthcare, criminal justice, car crashes, property damage, and lost worker productivity — most of which was not recovered from an 8-cent per gallon tax on beer.

In fact, the average alcoholic drink — whether consumed at home, on the town, or on the road — cost the state taxpayer a societal surcharge of $1.91.

Yet, polls show voters will likely approve the taxes on legal marijuana, even in a traditionally libertarian Western state with high resistance to new taxes. An estimate from state fiscal analysts predicted revenue of $70 million per year from the taxes, although a rough draft of the state’s 2014-2015 budget doesn’t include marijuana tax revenue.

Some analysts predict a few tiers of marijuana consumption in the years ahead. Some consumers will buy taxed marijuana products, while others will grow their own, legally, and tax-free. A third tier of consumers will make purchases on the black market, also tax-free. A failure to collect promised marijuana revenue from consumers may dissuade other states from legalizing marijuana, as most Americans don’t use the drug for any purpose, recreational or medicinal. With a societal cost from addictive substances, legal and illegal, voters and government officials may wish to see evidence of an offsetting benefit for society, such as revenues directed specifically toward social services.

"Taxes are an opportunity for marijuana to show it can play a valuable role in the community," Joe Megyesy, spokesman for Medicinal Colorado, a group supporting the taxes.

By their estimate, an ounce of medium-quality marijuana would provide the wholesaler and retailer each with $95, with $64.37 in state and local taxes for a total consumer price of $254.37. Thousands of patients qualifying for the state’s pre-existing medical marijuana program would continue to pay a nominal yearly fee for their marijuana supply.

Still, analysts remain unsure of how the marijuana market would ultimately respond to taxation vis-à-vis supply and demand; nor does the state know whether its tracking system of video surveillance and radio-frequency identification tagging will sufficiently curtail tax cheating in the so-called “seed-to-store” regulatory scheme.

With marijuana now legalized by voters in Colorado and Washington, the RAND Corporation wonders whether the U.S. has now gone further than the Netherlands in relaxing marijuana regulation.

Likewise, in a report last month the United Nations expressed alarm over the growing marijuana legalization movement in America, with more states expected to follow this decade. UN drug control officials urged the U.S. government in a report “to take necessary measures to ensure full compliance with the international drug control treaties in its entire territory.”