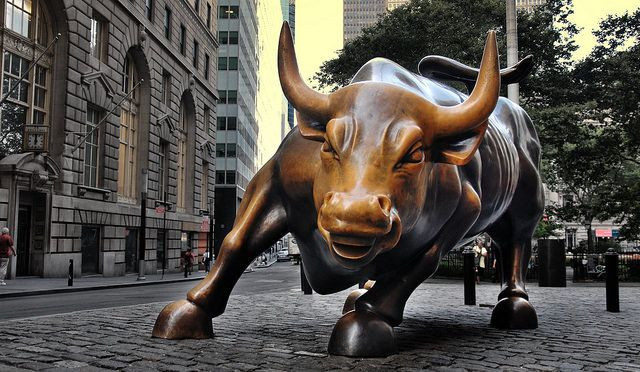

Confirmation Bias: Stock Market Traders Who Forecast Changes In Market Won't Adjust Predictions, Even With New Information

Everyone has that one friend who will argue a fact to death, even if what they believe is wrong. A new study from the University of Iowa has found this friend will argue their point no matter what, even if you prove them wrong and even if it ends up costing them money.

According to study co-author Tom Gruca, professor of marketing at the Tippie College of Business, this form of confirmation bias likely affects equity analysts who are responsible for forecasting changes in the stock market — it prevents new data from affecting their initial predictions. In a press release, Gruca said the new research could therefore help investors understand financial markets by giving them a glimpse into how stock traders think.

For the study, Gruca looked at student traders who were participated in the Iowa Electronic Markets, an online futures market at the Tippie College of Business where contract payoffs are based on real-world events. From 1998 to 2008, student traders analyzed market trends for 18 new movies, and bought and sold real-money contracts while trying to predict four-week opening box office totals of each movie.

Gruca found that even as initial box office receipts showed which stocks were rising or falling, the student traders ignored that information and stuck to their initial estimates. This kept the stock prices at relatively stable levels because nobody was buying or selling, as they were all influenced by confirmation bias. To find evidence of confirmation bias, the students traders explained why they forecasted the way they did before they began trading. Their explanations then exposed a phenomenon called the explanation effect — once someone has expressed their beliefs, they stand by them no matter what contradictory evidence may appear.

Gruca also had a control group that traded in several markets; they weren’t asked to write down or explain their forecasts, thus keeping clearing them of the explanation effect. Stock prices in these markets were much more active as well, which happened among the control group because they were more apt to adjust their opinions and use the new information while trading.

"This study shows that when all traders in a market have the same bias — in this case, confirmation bias — market prices are not efficient and do not reflect all of the information available," Gruca said. "However, if some traders are not biased, then market prices efficiently reflect new, relevant information."

Source: Cipriano, M, Gruca, T. The Power of Priors: How Confirmation Bias Impacts Market Prices. The Journal of Prediction Markets . 2015.